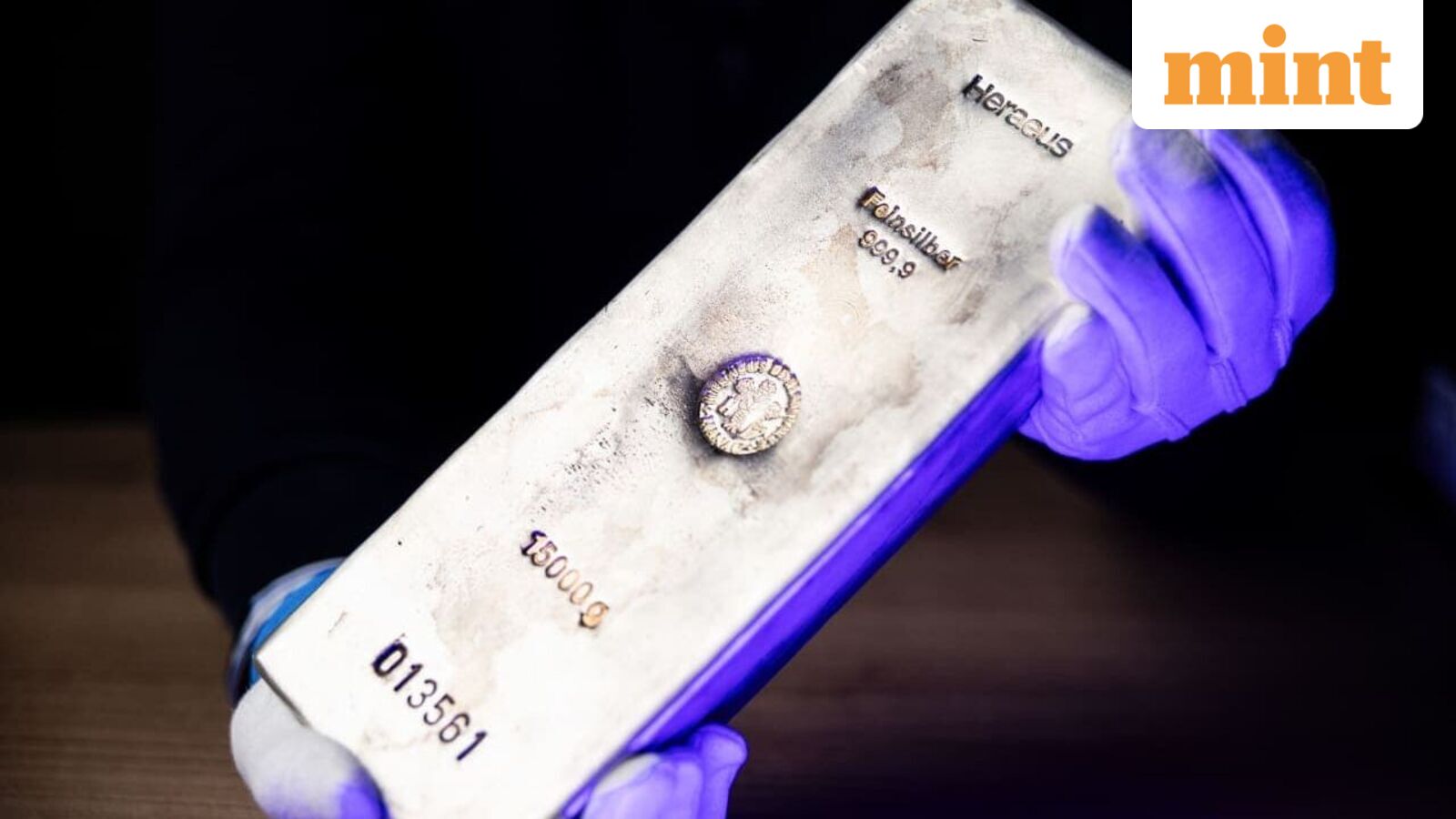

Silver price today: Silver prices crashed on Friday, January 30 declining 6% as a firmer US dollar weighed on sentiment, even as the metal remained on course for a historic month.

On MCX, Silver price fell 6% or to ₹3,75,900 after hitting a record high of ₹4,20,048/kg in the previous session (January 29). It is now down 10% or over ₹44,000 from its record high.

Globally, Spot silver slipped 0.2% to $115.83 an ounce after touching a fresh all-time high of $121.64 on Thursday. The white metal has surged about 62% so far this month, putting it on track for its strongest monthly performance on record.

The pause in the rally today came on the back of the dollar index inching higher, finding support after the US Federal Reserve kept interest rates unchanged earlier this week, though it remained set for a second consecutive weekly decline.

Fed Chair Jerome Powell said inflation in December was likely still above the central bank’s 2% target. Data showed weekly US jobless claims fell, signaling limited layoffs, even as subdued hiring kept labor market sentiment cautious. Furthermore, geopolitical tensions also stayed elevated amid reports that US President Donald Trump is weighing options against Iran.

Gold prices also retreated, with spot gold down 0.9% at $5,346.42 an ounce by 0124 GMT, after hitting a record $5,594.82 a day earlier. Gold has climbed over 24% in January, marking its biggest monthly rise since 1980, while US gold futures rose 1.3% to $5,390.80.

Among other metals, spot platinum fell 0.9% to $2,606.15 after a recent peak, while palladium gained 0.5% to $2,016.69.

Outlook and Next targets?

Policy uncertainty around economic growth, trade and fiscal sustainability continues to weigh on the US dollar, lifting volatility expectations and supporting precious metals. Ross Maxwell, Global Strategy Operations Lead at VT Markets, said this backdrop is constructive for safe havens, noting that “equities may grind higher, but with higher cross-asset volatility as markets adjust to a Fed that is increasingly sensitive to downside risks.” A softer or range-bound dollar tends to benefit gold and silver, while heightened uncertainty boosts demand for assets less exposed to policy missteps or fiscal stress. Globally, this dynamic can also ease financial conditions outside the US, supporting emerging market assets and commodities, even as overall risk sentiment remains fragile.

From a technical perspective, Renisha Chainani, Head of Research at Augmont, said gold sustaining above $5,600 ( ₹1,87,000) could pave the way for a move towards $5,800–6,000 ( ₹1,87,000–1,95,000), while strong support is seen near $5,200–5,020 ( ₹1,60,000). For silver, a decisive break above $118 ( ₹4,05,000) could open targets of $125–130 ( ₹4,30,000–4,50,000), with key support at $110 ( ₹3,75,000).

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.